[button link=”https://sfadvisors.com/wp-content/uploads/2016/04/Better-Investment-Brochure-V3.pdf” size=”small” style=”darkteal”]Investment Guide[/button] Check out our FREE GUIDE on Pursuing a Better Investment Experience

To see our other videos on Pursuing a Better Investment Experience, please Like Us on Facebook or Click Here to subscribe to our blog posts.

Many people concentrate their investment in their home stock market. They choose only U.S. stocks and mutual funds and consider their portfolio diversified. In some cases, they only hold a small group of securities. Yet, from a global perspective, limiting one’s investment universe to a handful of stocks, or even one stock market, is a concentrated strategy with possible risk and return implications.

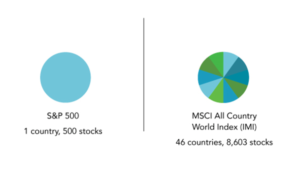

This illustration offers a conceptual comparison of investing only in the U.S. market, as represented by the S&P 500 Index, and structuring globally diversified portfolio that holds assets in markets around the world, as represented by the MSCI All Country World Index (IMI). For the global portfolio, holding over 8,600 stocks in 46 countries broadens one’s investment universe.

This illustration offers a conceptual comparison of investing only in the U.S. market, as represented by the S&P 500 Index, and structuring globally diversified portfolio that holds assets in markets around the world, as represented by the MSCI All Country World Index (IMI). For the global portfolio, holding over 8,600 stocks in 46 countries broadens one’s investment universe.

A diversified portfolio should be structured to hold multiple asset classes that represent different market areas across the world. Shoreline Financial Advisors can help you to structure a well-diversified portfolio.

Disclosure: Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. This information is for illustration purposes only. Indices are not available for direct investment and their performance does not reflect the expenses associated with the management of an actual portfolio. International investing involves special risks such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks. Past performance is no guarantee of future results.

Source: The S&P data are provided by Standard & Poor’s Index Services Group. MSCI data © MSCI 2015, all rights reserved. Number of holdings for the S&P 500 and MSCI All Country World Index-Investable Market Index (MSCI ACWI IMI) as of December 31, 2014.