What lower interest rates mean for you

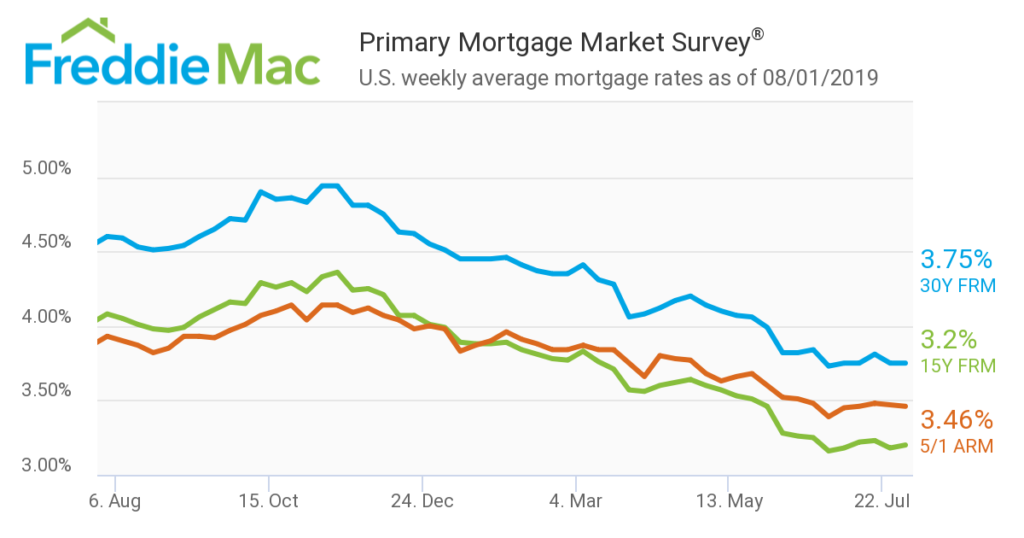

On August 5th the average interest rate for a 30-year fixed mortgage dipped to 3.70%. The 15-year fixed mortgage also sank to 3.20%, a 3-year low since late 2016 . This news suggests that 8.2 million 30-year mortgage holders could likely qualify to save at least 0.75% off their current interest rate by refinancing, according to a new tally by Black Knight, a mortgage software and analytics company.

Not only will these lower rates favor those looking to refinance, for borrowers, this is an unexpected gift. “Lower rates have also increased the buying power for prospective home buyers looking to purchase the average-priced home by the equivalent of 15%. This infers that they could effectively buy $45,000 ‘more house’ while still keeping their payments the same as they would have been last fall,” said Ben Graboske, president of Black Knight Data and Analytics.

The image below highlights this past week’s changes:

Make sure you shop around

Nevertheless, just because rates have declined doesn’t mean consumers won’t still need to shop around. Surprisingly still, one-third of consumers find comparison shopping for a mortgage too confusing and time-consuming. The more you shop around, the more likely you are to secure a lower interest rate. By doing so, you not only boost your short-term cash flow but save money in the long term.

For a typical $250,000 mortgage, a borrower who shops around with one additional lender saves between $966 and $2,086, Freddie Mac reported. Borrowers who get five rate quotes save $2,914 — on average — with 80 percent of those shoppers who get five quotes saving between $2,089 and $3,904.

What about the APR

Another measure of cost worth watching is the APR. While the interest rate is a great way to gauge your monthly costs, the APR gives you a more complete overall picture of the cost of the loan. This percentage combines the interest rate plus many of the fees associated with getting a mortgage.

Fees to consider negotiating

By comparing lenders, you’ll see variations in fees. These include: lender origination fees, points, mortgage insurance premiums, third-party fees as well as customer service. As you gather loan estimates, pay close attention to the fees, advises Joe Zeibert, senior director of products, pricing and credit for Ally Home. If one lender charges higher fees than others, ask the lender to clarify what the fees are for and if they can be negotiated.

We are here to help

In the end, it’s your individual situation that should determine whether to refinance your mortgage. Not simply whether interest rates are rising or falling. If you are considering refinancing or purchasing a new home, make sure you fully understand your financial goals. Our team at Shoreline Financial Advisors is here to help you. We will properly manage both risk and return to arrive at the right answers for you within the context of your overall financial picture.

Call us at (203) 458-6800