Avoid Market Timing

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to capture returns wherever they occur.

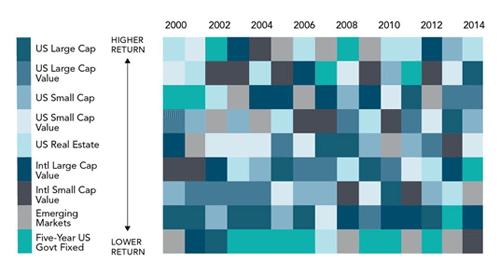

Annual Returns by Market Index

This slide features annual ranked performance of major asset classes in the US and international markets from 2000 through 2014. The asset classes are represented by corresponding market indices. Each asset class is represented by a different shade of blue.

This slide features annual ranked performance of major asset classes in the US and international markets from 2000 through 2014. The asset classes are represented by corresponding market indices. Each asset class is represented by a different shade of blue.

Even with a globally diversified portfolio, market movements can tempt investors to switch asset classes based on predictions of future performance. But as shown in this table, there is little predictability in asset class performance from one year to the next.

The data shows no obvious pattern of performance across asset classes, suggesting that predicting future performance is a difficult task. The charts offer additional evidence of market efficiency and make a strong case for investors to rely on portfolio structure, rather than market timing, to pursue returns.

To read similar articles, see the SFA 8-Part Series.

[button link=”/contact” size=”small” style=”darkteal”]Contact us →[/button] [button link=”/our-services” size=”small” style=”beige”]Our Services →[/button] [button link=”/team” size=”small” style=”beige”]Meet The Team →[/button] [button link=”/working-with-a-fiduciary” size=”small” style=”beige”]Conflict-Free Advice →[/button]