Practice Smart Diversification

Diversification helps reduce risks that have no expected return, but diversifying within your home market is not enough. Global diversification can broaden your investment universe.

Many people concentrate their investment in their home stock market. They choose only US stocks and mutual funds and consider their portfolio diversified. In some cases, they only hold a small group of securities. Yet, from a global perspective, limiting one’s investment universe to a handful of stocks, or even one stock market, is a concentrated strategy with possible risk and return implications.

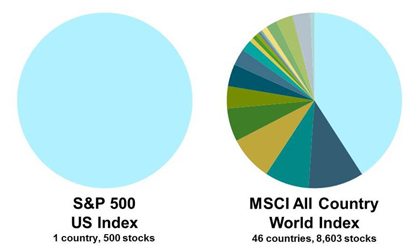

This slide offers a conceptual comparison of investing only in the US market, as represented by the S&P 500 Index, and structuring a globally diversified portfolio that holds assets in markets around the world, as represented by the MSCI All Country World Index (IMI). For the global portfolio, holding over 8,600 stocks in 46 countries broadens one’s investment universe.

A diversified portfolio should be structured to hold multiple asset classes that represent different market areas across the world.

To read similar articles, see the SFA 8-Part Series.

[button link=”/contact” size=”small” style=”darkteal”]Contact us →[/button] [button link=”/our-services” size=”small” style=”beige”]Our Services →[/button] [button link=”/team” size=”small” style=”beige”]Meet The Team →[/button] [button link=”/working-with-a-fiduciary” size=”small” style=”beige”]Conflict-Free Advice →[/button]