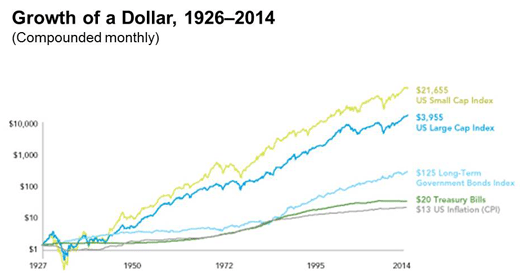

The financial markets have rewarded long-term investors. Historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

Most people look to the financial markets as their main investment avenue — and the good news is that the capital markets have rewarded long-term investors. The markets represent capitalism at work. This is documented in the growth of wealth graph shown.

The data illustrates the beneficial role of stocks in creating real wealth over long periods of time. T-bills have barely covered inflation, while longer-term bonds have provided higher returns over inflation. US stock returns have far exceeded inflation and significantly outperformed bonds.

Another key point is that not all stocks or bonds are the same. For example, consider the performance of US small cap stocks vs. large cap stocks over this time period. A dollar invested in small cap stocks in 1926 would be worth more than $21,000 in 2014, compared to more than $3,900 for large cap stocks. Keep in mind that there’s risk and uncertainty in the markets. Historical results may not be repeated in the future.

As a fiduciary, SFA can structure the best approach to putting your money to work in order to benefit from the fruits of capitalism.