EWA of CT, formally Shoreline Financial Advisors, pursues an investment philosophy built upon evidence based principals based on sound academic research. Our investment philosophy is structured to capture the markets’ return. Further, it is designed reduce the risk of bad timing affecting your long-term portfolio value by removing emotion from investment decisions. Finally, it works to improve the probability that your financial plan will be successful.

The United States, in addition to much of the world, is based on capitalism. The long-term growth of stock markets is a reflection of the growth of the earnings of the companies that make up the stock market. This growth in total earnings is a result of the growth of economies.

The principals outlined below are the foundational structure of our investment approach to building wealth. Please take a few minutes to scroll through and read the ten slides.

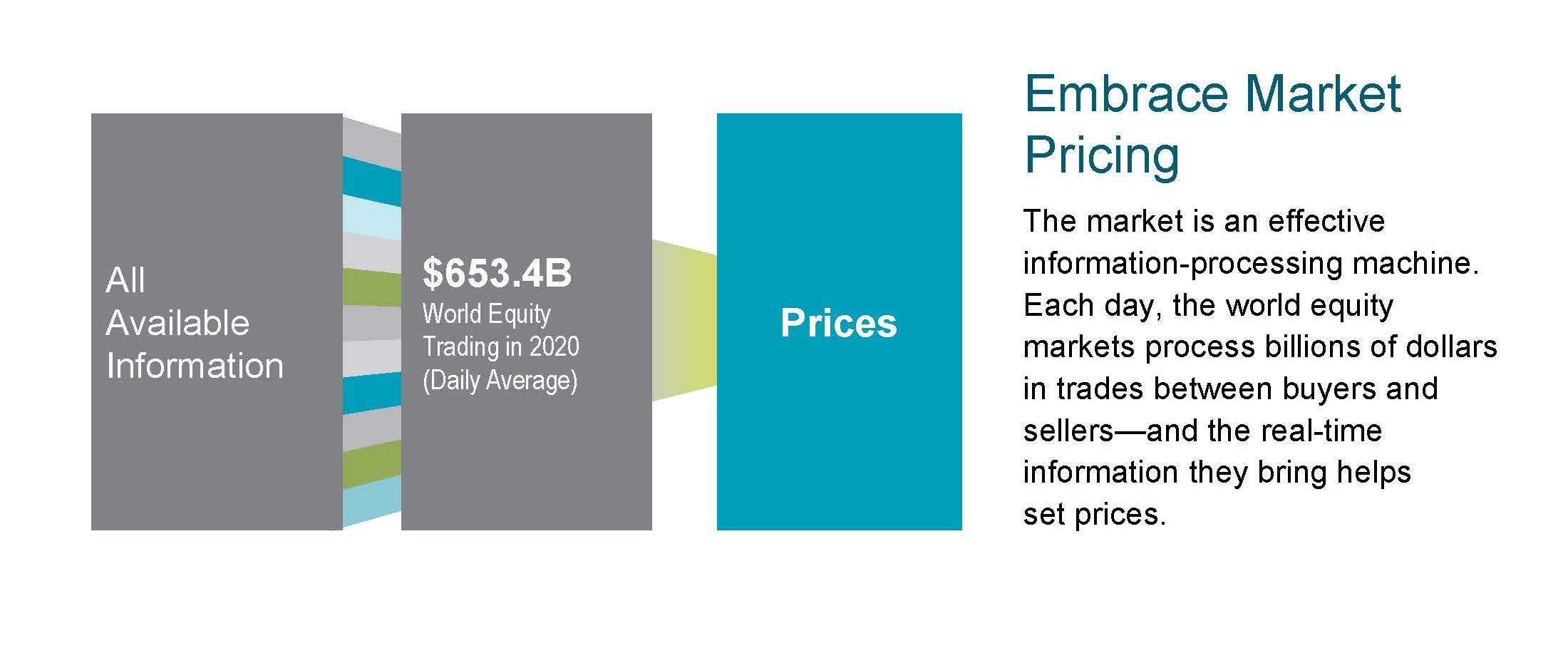

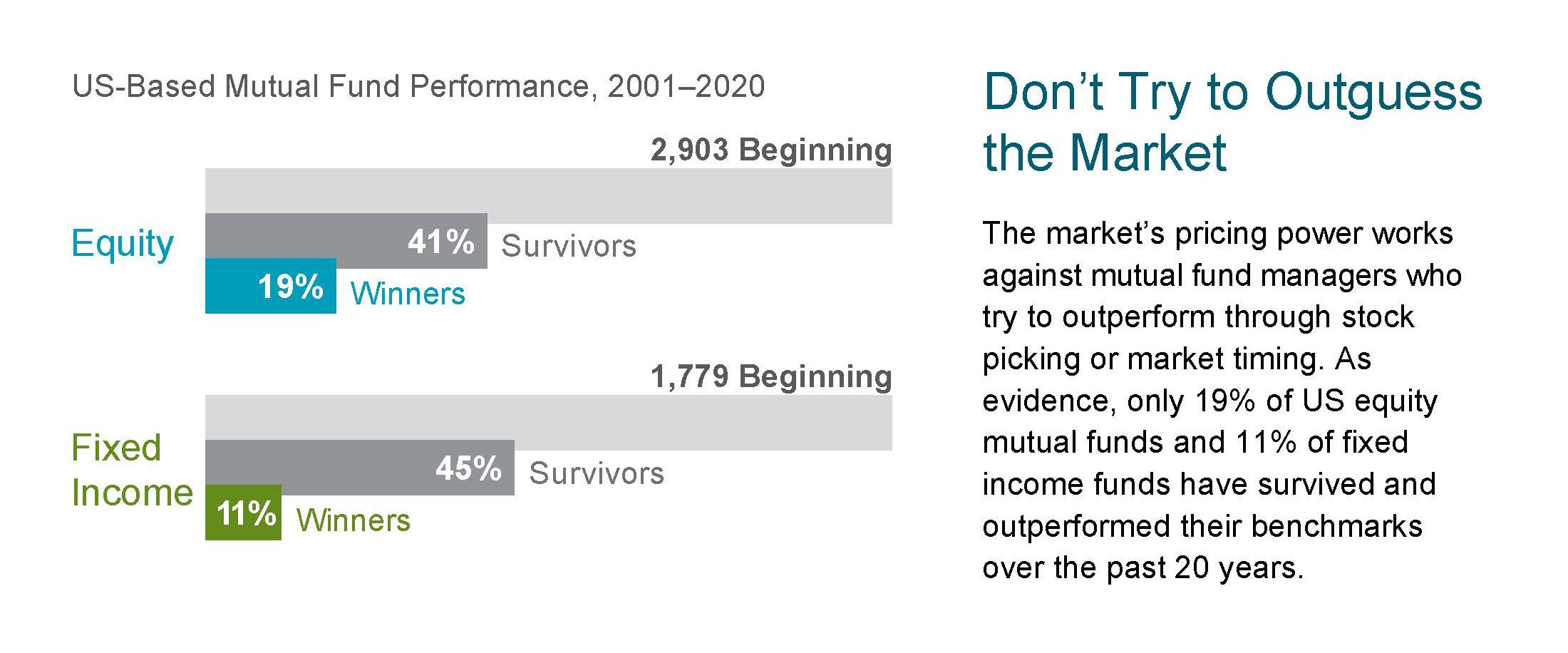

The market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers--and the real-time information they bring helps set prices.

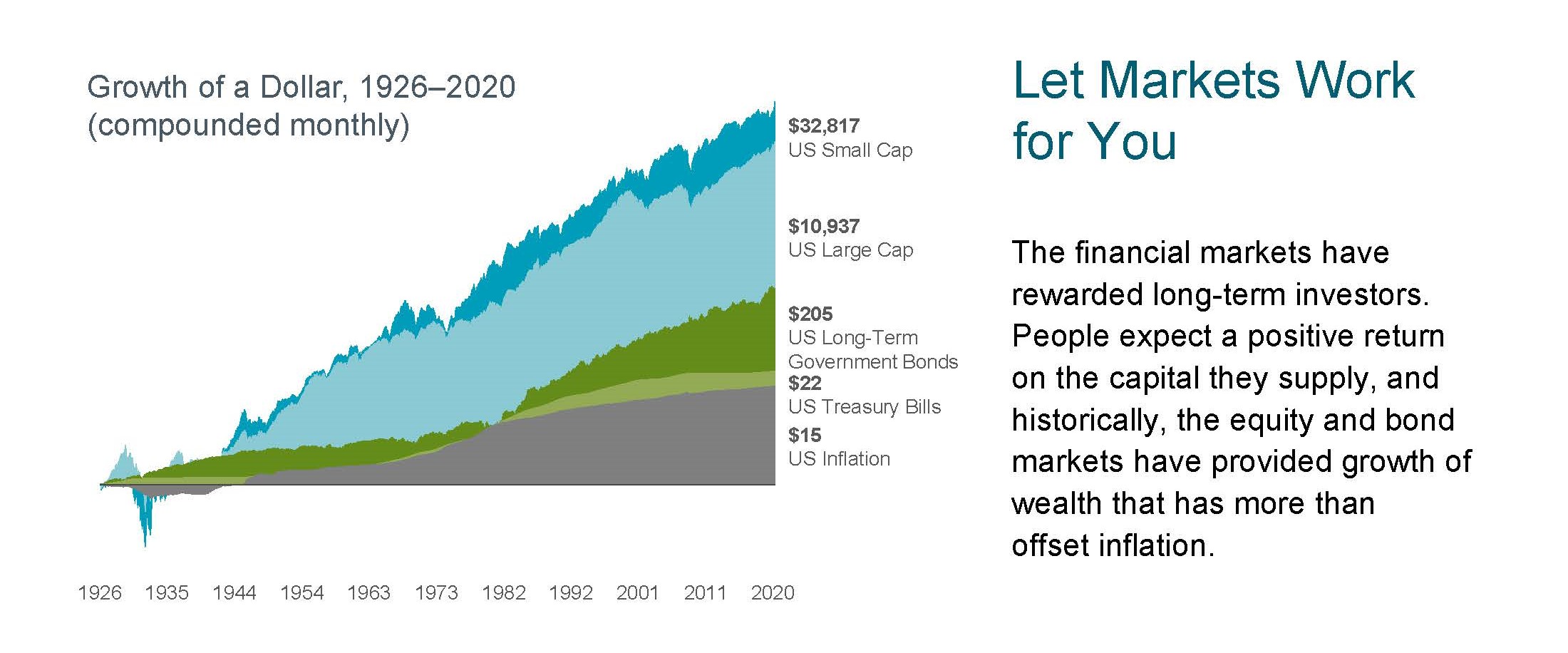

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

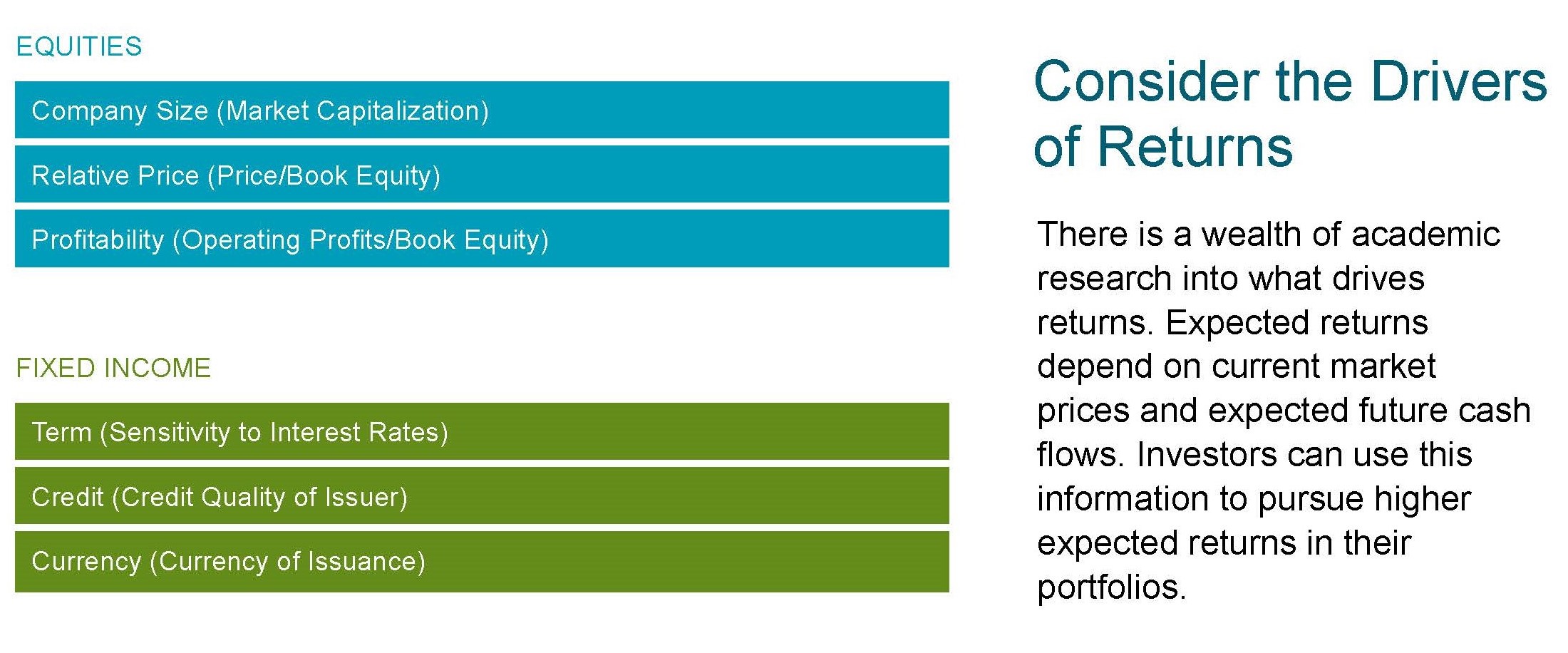

There is a wealth of academic research into what drives returns. Expected returns depend on current market prices and expected future cash flows. Investors can use this information to pursue higher expected returns in their portfolios.

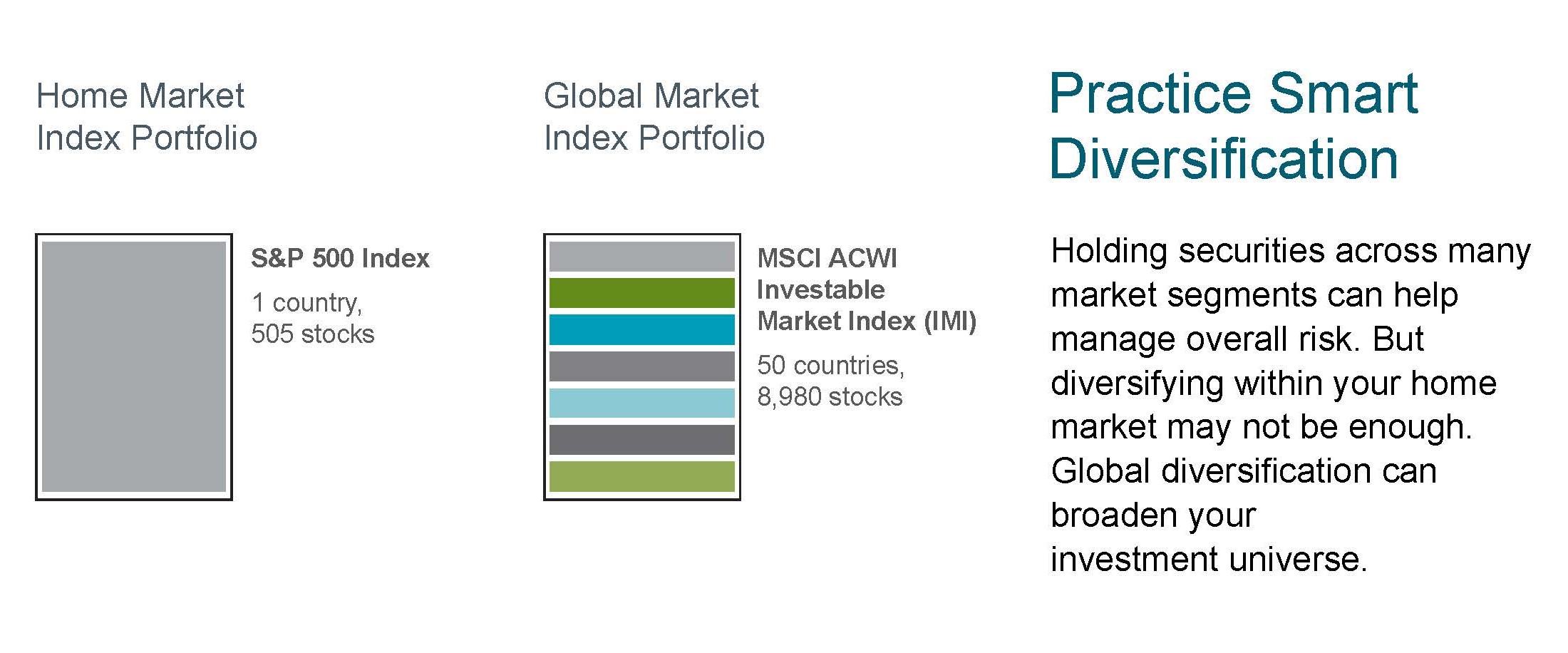

Holding securities across many market segments can help manage overall risk. But diversifying within your home market may not be enough. Global diversification can broaden your investment universe.

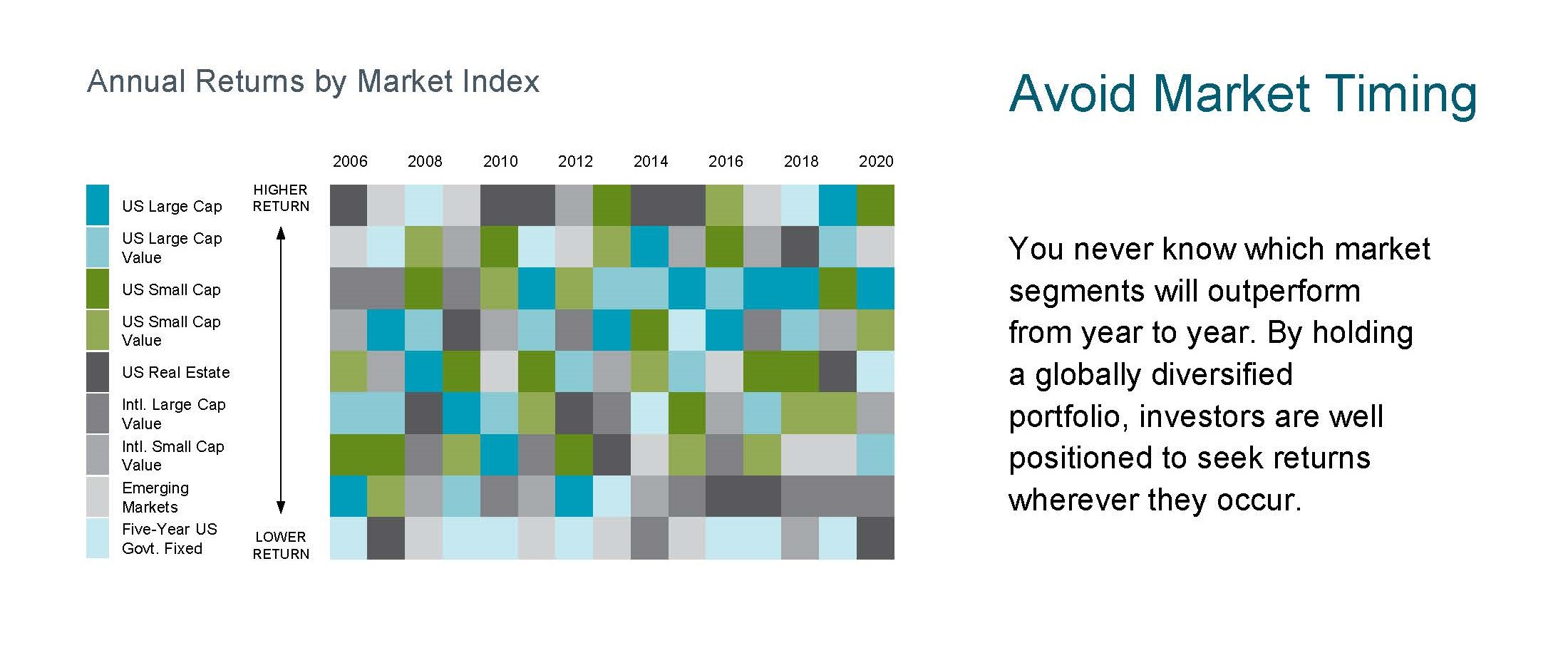

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur.

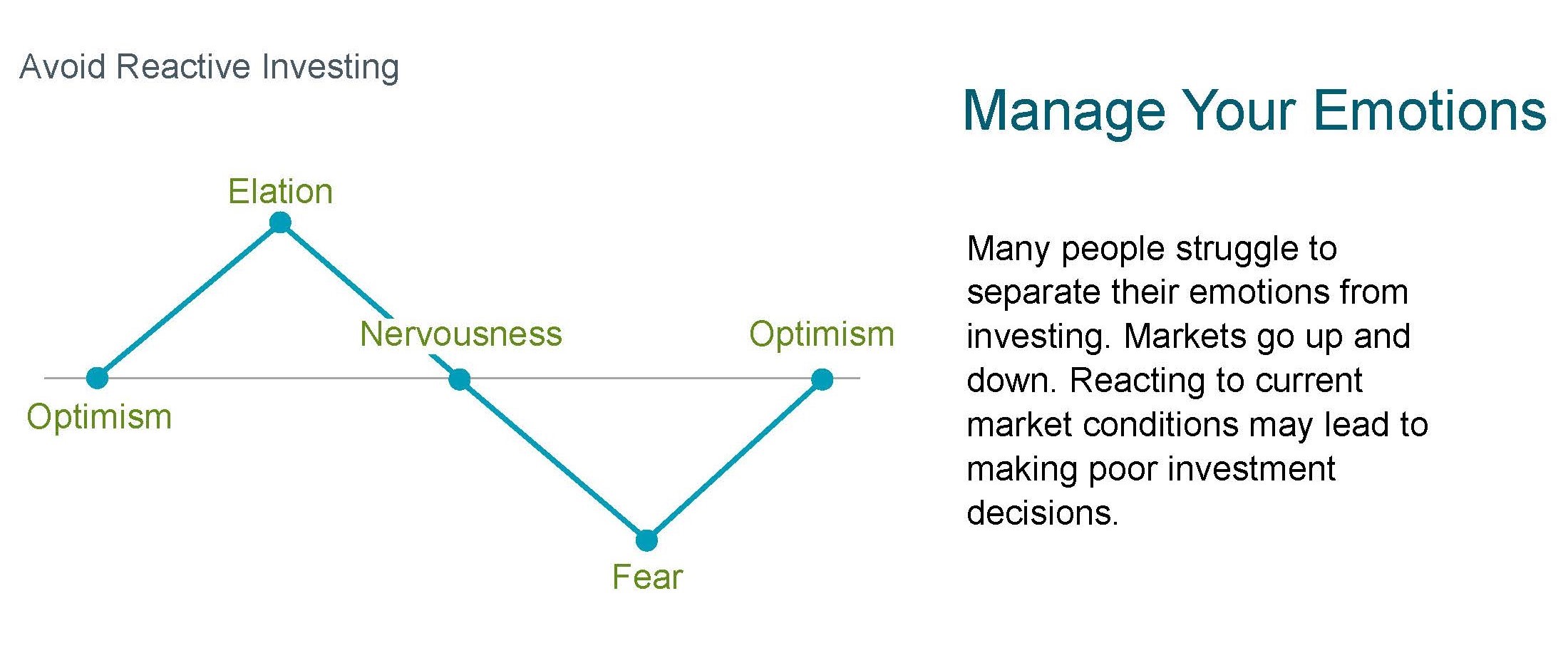

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.

Daily market news and commentary can challenge your investment discipline.

Some message stir anxiety about the future, while others tempt you to chase the latest investment fad. When headlines unsettle you, consider the source and maintain long-term perspective.

A financial advisor can offer expertise and guidance to help you focus on actions that add value. This can lead to a better investment experience.

Your investment portfolio should be low-cost, easy to understand, and transparent. To have the best chance for success, there are certain DOs and DON’Ts. As an RIA, here are ours.

We Don't

- Accept sales commissions or third-party payments.

- Accept incentives or bonuses to sell certain investment products.

- Invest portfolios in a few “great ideas.”

- Trade frequently.

We Do

- Put you first.

- Minimize expenses by finding low cost effective investment vehicles.

- Increase the chances of good performance by focusing on long term strategies based on our investment philosophy.

- Companies that are more profitable outperform those that are less profitable.*

- Small companies outperform larger companies.*

- Companies that are a better value outperform those that are more expensive.*

As an RIA, we are a fiduciary. We offer independent advice with no hidden charges, incentive structures, or third-party payments of any kind. Ready to take the next step? Let’s talk about how we can get you there.