It’s deja vu all over again. – Yogi Berra

As we look back at the third quarter of 2015 and in fact the past five years, the famous quote from the late Yogi Berra comes to mind. Since the bottom of the past bear market in March of 2009, we have had a reasonably steady upwards bias in stock markets. More interestingly, there has been a persistent outperformance by growth stocks versus value stocks. Growth stock companies tend to have several characteristics; among them, a promise of higher earnings and cash flows in the future as opposed to today, lower or non-existent dividends, and higher multiples of earnings, book value and cash flow. In essence, they are companies to which investors have built in higher expectations of their future prospects.

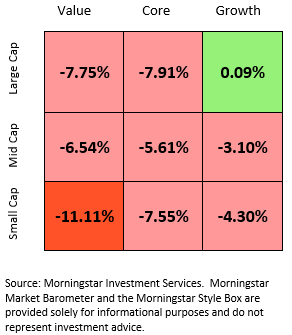

To quantify this, the stock market returns year-to-date are shown on the table above. While the overall return of the Morningstar US Market Index was -5.3%, the various sub-indices show far more detail. In these nine months, large company value stocks have returned -7.75% while large company growth stocks have returned a meagre but positive 0.09%. Further, over the past year through 9/30/15, large company value stocks have returned -5.8% while large company growth stocks have returned 4.4%; an even greater differential of 10.2%. Over the past three and five years, this differential is 5% and 4.8% per annum respectively.

We have been here before. According to data compiled by Dow Jones, the five year periods ended at year end 1999 and 1991 were also better for growth stock investing. But the pendulum swings and these and other growth stock phases were always followed by a period where value stocks triumphed. After the “nifty-fifty” stocks of the early ‘70s, the “dot-com” stocks of the late ‘90s, value stocks prevailed.

More interestingly, over very long periods of time, value stocks outperform growth stocks by about one percent while producing less volatility. Further, small companies, and in particular small value companies, have generated the highest appreciation. Unfortunately, none of these conclusions can help an investor make short term predictions but they can help investors position their investments for the most probable outcome in the long run.

[hr]