Cautious Optimism

Remember, things are never clear until it’s too late. ― Peter Lynch, One Up On Wall Street

The first half of 2020 will be remembered as a period of great uncertainty in the job market, of tragic outcomes from the COVID-19 virus and of extremely high volatility in capital markets. Claims for unemployment reached levels not seen since the Depression, deaths from the virus have already claimed two times more people than the worst flu season in the past ten years and stock market volatility matched that of the Great Recession.

Yet, the stock market has clawed back to within 6 percent of its all-time high as we write. It would appear that the stock market doesn’t reflect the current reality. As Peter Lynch, the famous fund manager from Fidelity states above, the market looks to the future, so investment opportunities have largely been captured by the time the effects of the crisis have dissipated. For now, the market is looking forward to economic recovery with cautious optimism.

Split Personality

It takes remarkable patience to hold on to an [investment] that excites you, but which everybody else seems to ignore. You begin to think everybody else is right and you are wrong. ― Peter Lynch, One Up On Wall Street

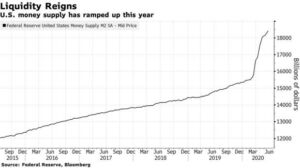

Turning to investments, we are in a bifurcated market unlike anything we have experienced in the last 20 years. Governments around the world have unleashed a tsunami of liquidity to replace normal economic flows (see graph below for US alone). Much of this wave has found its way into capital markets and as a result, like the late 1990s, an increasingly narrower group of stocks are accounting for most of the stock market’s return.

Turning to investments, we are in a bifurcated market unlike anything we have experienced in the last 20 years. Governments around the world have unleashed a tsunami of liquidity to replace normal economic flows (see graph below for US alone). Much of this wave has found its way into capital markets and as a result, like the late 1990s, an increasingly narrower group of stocks are accounting for most of the stock market’s return.

These distortions of capital markets have created large disparities in the valuations of certain investment classes and styles. Particularly, the gap within the value versus growth styles and US versus international asset classes have widened dramatically.

Outlook

Many of the large investment firms produce 7, 10 and even 20 year return outlooks for various asset classes such as small companies, large companies, international and emerging market companies as well as fixed income and value versus growth. We monitor these regularly as these are longer term forecasts and therefore have a higher probability for accuracy. A current survey of several top investment firms reveals some interesting forecasts. Remember, these are forecasts for the next 7 to 10 years.

- Value is expected to outperform growth by a range of 1.6% to 3.6%

- Small company stocks are expected to perform better than large by anywhere from 0.8% to 2.2%

- International is forecast to outperform US by a range of 0.9% to 2.6%

- Emerging markets have to best expected return with a range of 7.7% to 9.5%

- Long-term treasuries have lowest expected return at less than zero.

Your Portfolio

Over the past 4 months, we have adjusted portfolios with the changing conditions. As markets were falling in March, we bought stocks and sold bonds to take advantage of better valuations and added high yield, which had become attractive, to the fixed income part of portfolios.

In June, we rebalanced again as stock markets had recovered to within 10% of their all-time highs.

Many but not all of the firms we monitor were expecting a rise in inflation. With all this liquidity in the market, these firms are forecasting a higher probability of inflation in the next 5-10 years. In the May rebalance, we have initiated investments in Inflation Protection Bonds in fixed income portfolios.

We Are Here, Virtually

While we are still not meeting with clients face-to-face, we are meeting virtually so please do not hesitate to contact us with any questions regarding your account. Further, if your financial circumstances have changed, please call the office to set up an appointment to review your plan. We thank you very much for the trust you have placed in our firm.

Best regards,

Shoreline Financial Advisors, LLC