How is Social Security Taxed?

It is important to know that 0%, 50%, or 85% of your social security benefits may be subject to tax. This is dependent on your combined income level. Combined income is the sum of your adjusted gross income, your nontaxable interest, and half of your social security benefits.

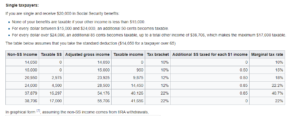

How is Social Security Taxed for Single Filers?

If your combined income is below $25,000, 0% of your social security benefits will be taxable. For individuals with combined income between $25,000 and $34,000, 50% of your social security benefits will be taxable and for those with combined income greater than $34,000, 85% of your benefits will be taxable.

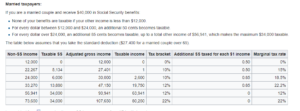

How is Social Security Taxed for Married Filing Jointly Filers?

If your combined income is below $32,000, 0% of your social security benefits will be taxable. For those MFJ with combined income between $32,000 and $44,000, 50% of your social security benefits will be taxable and for those with combined income greater than $44,000, 85% of your benefits will be taxable.

For those married filing separately, the Social Security Administration reports that you will “probably pay taxes on your benefits.” For more information, visit the Social Security Administration’s “Benefits Planner.”

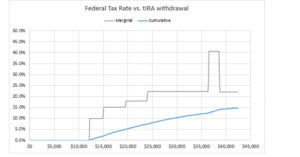

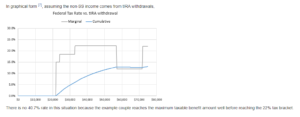

How Could Social Security Increase My Tax Rate?

As your combined income increases, more of your social security benefits are taxed resulting in you paying higher tax rates. This higher tax rate may be more than your expressed marginal tax rate. Please see the graphs below. In the fifth line of the graph below, although your marginal tax bracket is 22%, your marginal tax rate is 40.7%. We have noticed this can happen when clients begin taking their required minimum distributions and when they have increased capital gains.

Ready to learn more about Social Security?

For questions or comments, please send us a message.

Are you ready to set up a free, no obligation meeting?

The information contained on this Website is not intended as, and shall not be understood or construed as, financial, tax, or professional advice. The information contained on this Website is not a substitute for any advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided on this Website and the resources available for download are accurate. Regardless of anything to the contrary, nothing available on or through this Website should be understood as a recommendation. Neither the Company nor any of its employees or owners shall be held liable or responsible for any errors or omissions on this website.