Let’s debunk the top 5 Social Security myths

As a public insurance program, Social Security is a complex system. With so many misunderstandings about the program, it’s nearly a full-time job quashing Social Security myths. Because of this, many Americans fail to grasp program features that could have a major impact on their retirement finances.

According to the Center for Retirement Research at Boston College, Social Security “Is the most important source of retirement income for most workers. Yet too many older Americans lack a basic understanding of certain aspects of Social Security benefits.”

To help clarify, we want to break down the top Social Security issues that confuse most Americans.

Myth 1: Undocumented immigrants collect Social Security

Fact: Undocumented immigrants are not allowed to claim Social Security benefits. Yet these workers and their employers pay payroll taxes that benefit the bottom line of Social Security. In summary, they must abide by the same eligibility rules as everyone else.

The Congressional Research Service makes the rules around Social Security benefits for non-citizens very clear when they say, “If an individual never obtains work authorization, none of his or her Social Security covered earnings counts toward qualifying for benefits.”

Myth 2: Social Security is going bankrupt

Fact: Without a doubt, Social Security faces funding challenges. But not immediately and not bankruptcy. Social Security is a “pay as you go” system. Benefits are paid through payroll taxes collected from current workers and their employers.

Currently, the worker to retiree ratio has shifted. By next year, we’ll reach a point where there is not enough money coming into the system to pay out to people claiming benefits. To compensate for this shortage, the SSA will begin withdrawing money from the trust fund. The problem with this is that, according to the Social Security report, the current trust fund balance will only last until 2035. Once depleted, benefits can only be paid from Social Security taxes.

Projections

Projections show this will only generate 76% of what’s needed to pay all benefits. While this may be a pay cut, it is not bankruptcy. Most likely, adjustments will come in the form of reductions in benefits or an increase in taxes. Realistically, Social Security will not just disappear.

So long as payroll taxes exist, Social Security will never go broke.

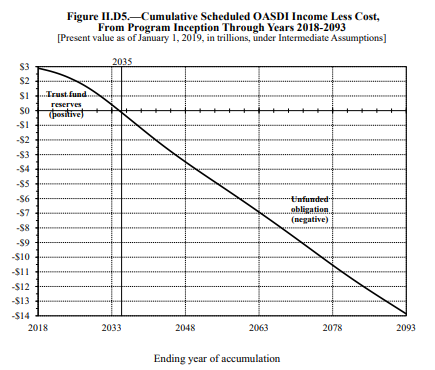

Figures II.D2, II.D4, and II.D5 show that the program’s financial

condition is worsening at the end of the projection period. Trends in annual

balances and cumulative values toward the end of the 75-year period provide an

indication of the program’s ability to maintain solvency beyond 75 years.

Consideration of summary measures alone for a 75-year period can lead to

incorrect perceptions and to policy prescriptions that do not achieve

Myth 3: Members of Congress don’t pay into the Social Security system

Fact: Since 1984, the president, federal employees and members of Congress are required to contribute to Social Security just like everyone else. Prior to 1984, there was the Civil Service Retirement System, which covered federal workers and officials. While some federal employees hired before 1984 had the option of sticking with the old system, everyone hired since falls under Social Security.

Myth 4: You’ll never get back what you put in

Fact: Not only do you get what you pay in to Social Security… you get that, and then some. To begin, you don’t get back exactly what you put into the system in the first place. Benefits are based on your 35 highest-earning years. Whether you will get back more or less than the amount of tax you paid into the system depends on several factors. These include: your earnings and taxes paid during your career, your age when you claim benefits, marital status, and how long you (and your spouse) live to collect benefits.

In some cases younger beneficiaries, both singles and some two-earner couples, will pay more in Social Security taxes than they get out, but after taking Medicare into account, people in all cases come out ahead, according to a 2013 study “Social Security and Medicare Lifetime Benefits and Taxes,” by Urban Institute.

Myth 5: If you don’t claim early, you risk not getting your fair share

Fact: The drawback of taking Social Security before full retirement age is that your monthly benefits will be reduced, not just at that point but for the rest of your life. Someone who starts collecting benefits at 62 will receive only 75% as much money each month as they would have received if they had waited until Full Retirement Age (FRA) of 66. Better yet, if you can wait to age 70, the age your benefits max out, you receive even more each month.

It is important to keep in mind that if you file before your full retirement age, the earnings limit will apply. As of 2019, the annual earnings limit for those under FRA is $17,640. As a result, if you are collecting Social Security benefits, and earn more than the annual earnings limit, Social Security will take back $1 for every $2 over the limit. This is a significant reduction. Upon passing your FRA, the earnings limit will no longer apply.

In summary

Now that we’ve sorted out fact from fiction, you can use this information to help make educated decision about when to start Social Security and how much of your retirement savings it will cover. Lastly, it is important to note that everyone’s case is different and Social Security is anything but simple to understand.

Shoreline Financial Advisors is here to work with you and explore options on how and when to claim your benefits.

Additionally, should you have questions about Social Security or would like to see what your benefit might be if you collect at 62, at full retirement age, or even later, visit the Social Security website or one of the SSA’s local offices.