TIMING ISN’T EVERYTHING

In our recent discussions, some have asked whether it is time to “take some money off the table” or “should we take a more defensive position since a recession is imminent.” The lure of getting in at the right time or avoiding the next downturn may tempt even disciplined, long-term investors. The reality of successfully timing markets, however, isn’t as straightforward as it sounds.

OUTGUESSING THE MARKET IS DIFFICULT

Attempting to buy individual stocks or make tactical asset allocation changes at exactly the “right” time presents investors with substantial challenges. First and foremost, markets are fiercely competitive and adept at processing information. During 2018, global daily equity trading volume averaged of $462.8 billion.[1] The combined effect of all this buying and selling is that available information, from economic data to investor preferences and so on, is quickly incorporated into market prices.

Trying to time the market based on an article from this morning’s newspaper or a segment from financial television? It’s likely that information is already reflected in prices by the time an investor can react to it.

THEY STUDIES PROVE IT

Dimensional recently studied the performance of actively managed mutual funds. They found that even professional investors have difficulty beating the market. Over the last 20 years, 77% of equity funds and 92% of fixed income funds failed to survive and outperform their benchmarks after costs.[2]

Further complicating matters, for investors to have a shot at successfully timing the market, they must make the call to buy or sell stocks correctly not just once, but twice. Professor Robert Merton, a Nobel laureate, said it well in a recent interview with Dimensional:

“Timing markets is the dream of everybody. Suppose I could verify that I’m a .700 hitter in calling market turns. That’s pretty good; you’d hire me right away. But to be a good market timer, you’ve got to do it twice. What if the chances of me getting it right were independent each time? They’re not. But if they were, that’s 0.7 times 0.7. That’s less than 50-50. So, market timing is horribly difficult to do.”

TIME AND THE MARKET

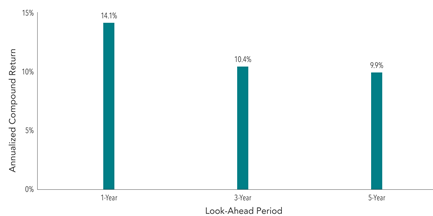

The

S&P 500 Index has logged an incredible decade. Should this result impact investors’

allocations to equities? Exhibit 1 suggests that new market

highs have not been a harbinger of negative returns to come. The S&P 500 went on to provide positive

average annualized returns over one, three, and five years following new market

highs.

[1]. In US dollars. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. ETFs and funds are excluded.

[2]. Mutual Fund Landscape 2019.

Exhibit

1.

Average

Annualized Returns After New Market Highs

S&P 500, January 1926–December 2018

In US dollars. Past performance is no guarantee of future results. New market highs are defined as months ending with the market above all previous levels for the sample period. Annualized compound returns are computed for the relevant time periods subsequent to new market highs and averaged across all new market high observations. There were 1,115 observation months in the sample. January 1990–present: S&P 500 Total Returns Index. S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. January 1926–December 1989; S&P 500 Total Return Index, Stocks, Bonds, Bills and Inflation Yearbook™, Ibbotson Associates, Chicago. For illustrative purposes only. Index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the management of an actual portfolio. There is always a risk that an investor may lose money.

CONCLUSION

Outguessing markets is more difficult than many investors might think. While favorable timing is theoretically possible, there isn’t much evidence that it can be done reliably, even by professional investors. The positive news is that investors don’t need to be able to time markets to have a good investment experience.

Over time, capital markets have rewarded investors who have taken a long-term perspective and remained disciplined in the face of short-term noise. By focusing on the things they can control (like having an appropriate asset allocation, diversification, and managing expenses, turnover, and taxes) investors can better position themselves to make the most of what capital markets have to offer.

We thank you very much for the trust you have placed in our firm. Please do not hesitate to contact us with any questions. Further, if your financial circumstances have changed, please call the office to set up an appointment to review your plan.

Best regards,

Shoreline Financial Advisors, LLC

Source: Dimensional Fund Advisors LP.

DISCLOSURE

There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Robert Merton provides consulting services to Dimensional Fund Advisors LP.