[button link=”https://sfadvisors.com/wp-content/uploads/2016/04/Better-Investment-Brochure-V3.pdf” size=”small” style=”darkteal”]Investment Guide[/button] Check out our FREE GUIDE on Pursuing a Better Investment Experience

To see our other videos on Pursuing a Better Investment Experience

Please Like Us on Facebook or Click Here to subscribe to our blog posts.

The Threat Of Inflation In Your Portfolio

To achieve a better investment experience, let’s begin by considering what you want to accomplish as an investor. Why do people invest at all? One major reason is to grow their wealth in preparation for, or during their retirement. Whatever their reason for accumulating and investing money, there’s another concern that creates the need to save and invest: the threat of inflation in your portfolio.

Inflation erodes the real purchasing power of your wealth in your portfolio.

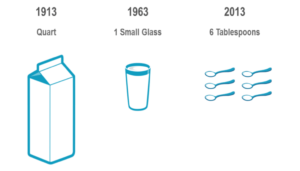

Consider an illustration of the effects of inflation over time. In 1913, nine cents would buy a quart of milk. Fifty years later, nine cents would only buy a small glass of milk. And 100 year later, nine cents would only buy about six tablespoons of milk. So, as the value of a dollar declines over time, you invest to grow wealth and preserve purchasing power.

We often hear people say, “yes, but investing is risky.” But considering the long-term threat of inflation, not investing means taking risks, too. If you don’t grow your money, you may not be able to afford things in the future.

Source: Consumer Price Index