Should I Stay or Should I Go

The English band The Clash had no idea in 1981 how prescient the title to their #1 single would be to stock markets around the world 35 years later. The UK voted on the 23rd of June to exit the European Union (EU) and its Common Market after 44 years of membership to the EU and the European Economic Community (EEC). It has always been a tricky relationship. The UK was not one of the original members of the EEC which was created through the Treaty of Rome in 1957. They applied for membership in 1963 and in 1967 and were rejected by Charles de Gaulle, the President of France at the time. In 1972, with de Gaulle no longer in office, the UK applied once more and was accepted in 1973.

By 1975, the ruling Labor Party called a referendum to withdraw from the EEC which was soundly defeated 67-33. In 1983, the Labor Party campaigned heavily on the commitment to withdraw and was routed in general elections.

If I Go There Will Be Trouble

Maybe not. Now that the UK electorate has voted to leave the EU, its subsequent relationship with the remaining EU members could take several forms. These include remaining in the European Economic Area (EEA) as a European Free Trade Association (EFTA) member (alongside Iceland, Liechtenstein and Norway), or seeking to negotiate bilateral terms more along the Swiss model. The Swiss agreements contain free movement for EU citizens.

Maybe not. Now that the UK electorate has voted to leave the EU, its subsequent relationship with the remaining EU members could take several forms. These include remaining in the European Economic Area (EEA) as a European Free Trade Association (EFTA) member (alongside Iceland, Liechtenstein and Norway), or seeking to negotiate bilateral terms more along the Swiss model. The Swiss agreements contain free movement for EU citizens.

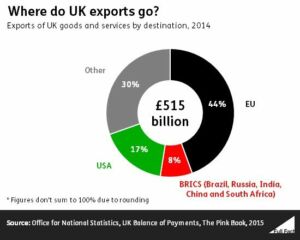

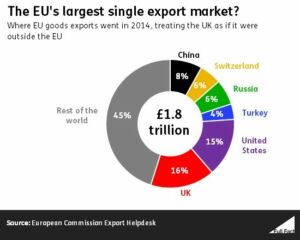

From an economic standpoint, the vote to leave the EU may not be dramatic. European experts have argued that, beyond short-lived market volatility, the long term economic prospects of Britain remain high, notably in terms of country attractiveness and foreign direct investment. The two charts demonstrate that the UK and the EU remain intertwined with 44% of British exports going to the EU and 16% of EU exports going to the UK.

The vote to leave should have little direct impact on the U.S. economy over the long term. U.S. economy is heavily driven by the U.S. consumers. Roughly 70% of our GDP is derived from consumer spending. The consumer in the U.S. is beginning to benefit from tighter labor markets and rising income expectations that are little impacted by the vote in the U.K. While business activity has moderated some of late, the underlying trend there has remained solid as well. As a result, our U.S. macro view has not changed—the U.S. continues to experience a mix of mid- and late-cycle indicators, and the odds of recession remain low.

The vote to leave should have little direct impact on the U.S. economy over the long term. U.S. economy is heavily driven by the U.S. consumers. Roughly 70% of our GDP is derived from consumer spending. The consumer in the U.S. is beginning to benefit from tighter labor markets and rising income expectations that are little impacted by the vote in the U.K. While business activity has moderated some of late, the underlying trend there has remained solid as well. As a result, our U.S. macro view has not changed—the U.S. continues to experience a mix of mid- and late-cycle indicators, and the odds of recession remain low.

The Indecision’s Buggin’ Me

Again, the Clash wrap it up very nicely in that the crux of the issue remains in the uncertainty. The difficulties we faced making decisions in this kind of environment where emotions dominate our judgement can be very damaging.

[hr]