Manage Your Emotions

Reactive Investing in a Market Cycle

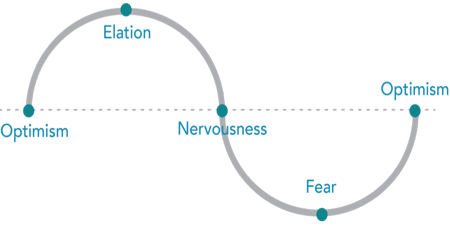

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions at the worst times.

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions at the worst times.

The idea behind investing is to buy low and sell high. Yet, following an emotional investment cycle sparked by reactive decisions may bring the opposite effect: buying at higher prices and selling at lower prices.

The 2008–09 global market downturn offers an example of how the cycle of fear and greed can drive an investor’s decisions. Some investors fled the market in early 2009, just before the rebound began. They locked in their losses and then experienced the stress of watching the markets climb.

Staying disciplined through rising and falling markets can pose a challenge, but it is crucial for long-term success.

To read similar articles, see the SFA 8-Part Series.

[button link=”/contact” size=”small” style=”darkteal”]Contact us →[/button] [button link=”/our-services” size=”small” style=”beige”]Our Services →[/button] [button link=”/team” size=”small” style=”beige”]Meet The Team →[/button] [button link=”/working-with-a-fiduciary” size=”small” style=”beige”]Conflict-Free Advice →[/button]