This process of Creative Destruction is the essential fact about capitalism. It is what capitalism consists in and what every capitalist concern has got to live in. – Joseph Schumpter, Capitalism, Socialism and Democracy, 1942

Innovation and Capitalism

The concept of creative destruction, which is commonly identified with Schumpter, was derived by him through the works of Karl Marx and his Communist Manifesto written in 1848. Originally composed by Marx as a criticism of capitalism’s tendency towards ceaseless self-destruction, Schumpter spun the concept around and pronounced it as the force of innovation that is essential to longer term economic growth.

The innovation we have been experiencing is the massive increase in processing speed and power of technology and this has enabled businesses to exist that were barely imaginable three decades ago. Unfortunately, this has come at a price, but first, we would like to review the year just ended and its implications on the new one.

| Index |

2013 Return (%) | 2014 Price / Earnings | Yield (%) |

Price / Book Value | Price / Cash Flow | LT Earning Growth | Risk (Std. Dev.) |

| S&P500 (Large US) | 32.4 | 16.2 | 2.1 | 2.4 | 8.3 | 9.2 | 12.1 |

| Russell 2000 (Small US) | 36.3 | 19.8 | 1.3 | 2.0 | 7.5 | 11.8 | 16.6 |

| EAFE (Developed International) | 22.8 | 14.1 | 2.8 | 1.5 | 4.8 | 10.1 | 16.4 |

| Emerging Markets | -2.3 | 10.7 | 3.0 | 1.4 | 4.2 | 11.6 | 19.4 |

| Barclays Aggregate Bond | -2.0 | n/a | 2.6 | 2.7 | |||

| Gold | -27.3 | n/a | 0.0 | n/a | n/a | n/a | 21.8 |

This past year certainly was notable for the strong dispersion of returns in capital markets. As we remarked in a previous letter, flows into equity mutual funds turned positive in 2013 after several years of outflows following the 2008/09 bear market. In the accompanying table, the 2013 returns for stocks in the United States were impressive. In fact, for the S&P 500, there have only been nine other years in the 85 year history of the index where appreciation has exceeded 30%. In the year following such a big increase, the index’s return has been as low as -12% to as high as 28% with an average of 11%. Also worth noting is the negative returns for bonds, emerging markets and gold. While we tend to be agnostic on precious metals and we expounded on our thoughts about bonds a year ago, we do believe that emerging markets represent a good entry point for those with patience and risk tolerance.

Is It Still a Buy?

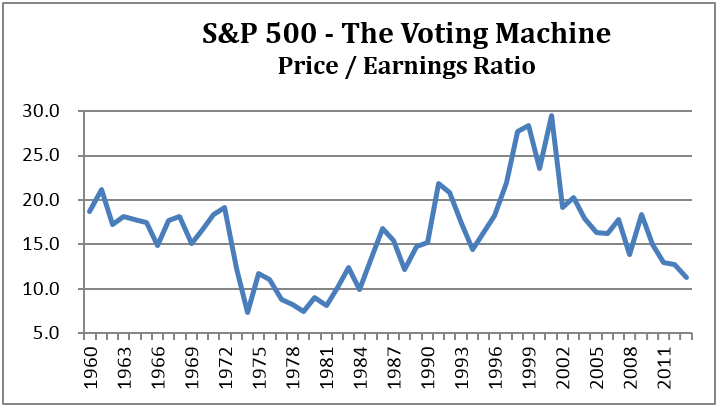

The chart on the following page was pulled from our 2nd Quarter 2012 Newsletter. We noted then that the market was trading at a 10% discount to its fifty year average. While valuations have certainly moved up, earnings (the long term driver of stock markets) in the United States has also increased. While not cheap, the market is within a normal range relative to the past fifty years. Looking at the table on the previous page, we would note that international stocks and, in particular, emerging market stocks represent better value than the US. Bear in mind, stocks are volatile and pullbacks of around 10% are common and declines of 20% or more have occurred on average, every three and a half years.

Unemployment Rates and Creative Destruction

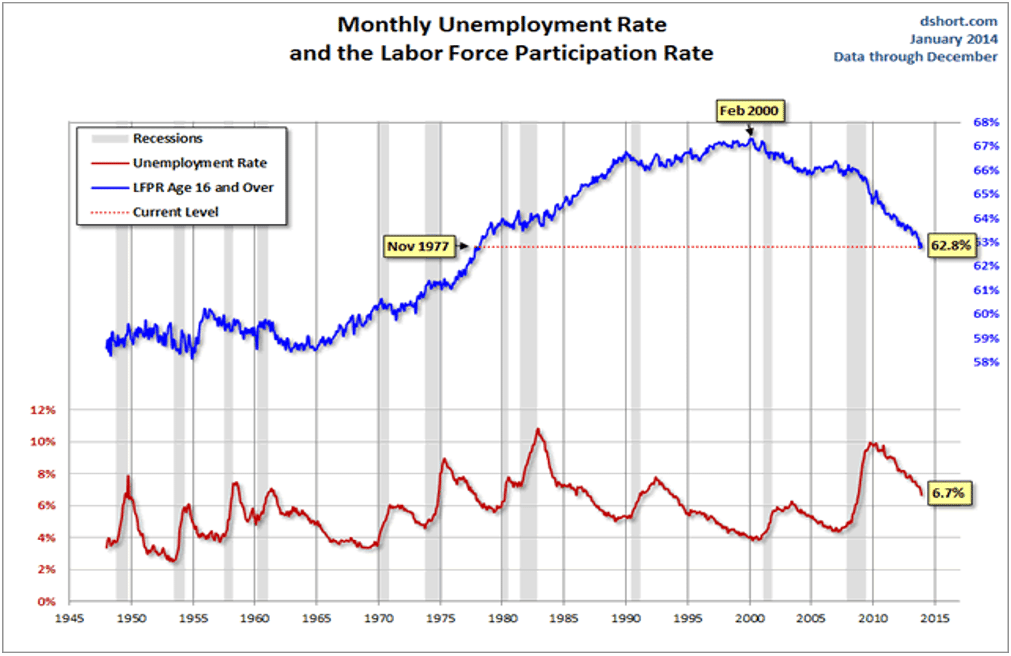

Although we are several years into the recovery, the lack of strong employment growth has confounded policy makers. The chart below shows unemployment in red and labor participation in blue. Unemployment only measures those who are actively seeking employment while Labor Participation measures total employment as a percent of the total labor force (whether you are seeking employment or not). Currently, only 62.8% of those old enough and capable of working are employed. This number has been declining since 2000 and the decline has accelerated since the last recession. Curiously, the decrease in labor partcipation has materially influenced the unemployment rate by reducing the number of those seeking employment and those unemployed; both the numerator and the denominator of the unemployment equation.

Some economists have posited that technology is significantly disrupting the workforce and that substantial retraining and re-education of the existing workforce will be necessary. Additionally, the new jobs that are being created require more technological knowledge and possibly less direct experience. As a result, younger tech-savy workers, requiring less compensation, have had an advantage. This has probably hastened the trend of early retirement as older workers become discouraged by the labor market and is possibly a prime causation of the reduced labor participation above. Some have even speculated that technology has accelerated internationalization and eroded labor’s bargaining power. As the transition matures and the labor force retools, labor will re-emerge and corporate profit margins will decline to normal levels. For now, capital retains the upper hand.

This is the downside of innovation and capitalism that Marx and Schumpter wrote about. We are living through a disruptive yet exciting time. Despite the “creative destruction” occuring within our labor force, we remain constructive on the long term benefits and the implications for earnings growth in the intermediate to long term.

[hr]