Multiple industries are seeing a rise in a new tactic of cyber-criminal activity that affects all consumers. Shoreline Financial Advisors wants to help you keep your information safe. Here are some tools and tips to help you defend technology fraud.

9 Practices you can adopt to help protect yourself against technology fraud:

Phishing

Fraudsters pose as credible companies “phishing” for your information. Often times a target is contacted by email, telephone or text message by someone posing as a legitimate institution. Phishing attempts have grown 65% in the last year. 15% of people successfully phished will be targeted at least one more time within the year.* Agencies like the Internal Revenue Service and Social Security will never call you to ask for your personal information, social security number or credit card information. If you receive an unexpected call from someone stating they are a representative from your bank seeking information to access your account, hang up and contact your bank directly.

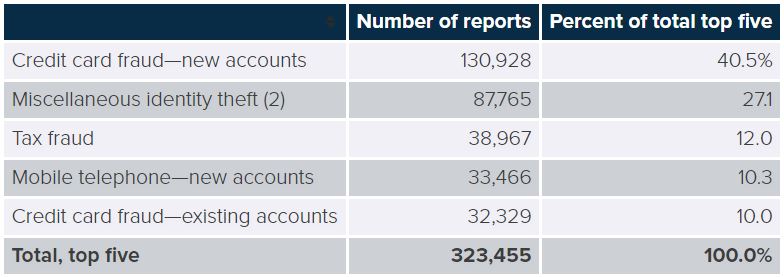

(1) Consumers can report multiple types of identity theft. In 2018, 17 percent of identity theft reports included more than one type of identity theft.

(2) Includes online shopping and payment account fraud, email and social media fraud, and medical services, insurance and securities account fraud, and other identity theft. Source: Federal Trade Commission, Consumer Sentinel Network.

Texts and Emails

Fraudsters impersonate companies seemingly familiar to you. They will direct you to links to provide personal information. These links send you to a website that looks authentic, but is actually just a carbon copy of the real one. Always report suspicious emails or texts to the Internet Crime Complaint Center (IC3).

MFA

A password is the first line of defense. Multifactor authentication (MFA) is a method in which a computer user is granted access only after successfully presenting two or more pieces of information. For example, a passcode texted to your cellphone.

Banking Alerts

Sign up for banking alerts. Your bank will contact you by email or text message when certain activity occurs on your accounts. Alerts should be used in addition to regularly checking your account balances.

Paperless

Paperless statements will eliminate the possibility of having your bank account information stolen from your mailbox. Additionally, shredding existing statements and receipts will reduce the chances of having bank account information stolen from your trash.

Debit Cards

Avoid using your debit card when making purchases. Using a credit card instead offers greater protection against fraud, loss or damage.

ATMs

Only use bank ATMs. They have better security (video cameras) than ATMs at convenience stores, restaurants, and other places.

Firewall, Anti-virus Spyware

Protect your computer and mobile devices by using a firewall, anti-virus spyware software. Update regularly!

Holiday Scams

As the end of the year approaches, be sure to not fall for holiday scams luring you into making extra money or deals that seem too good to be true. Stay up to date on the latest scams by reading the Federal Trade Commission’s page on recent scam alerts.

Anything you can do to make a thief’s work more difficult, whether it’s using a credit card instead of a debit card or multifactor authentication, will help safeguard your identity and accounts while decreasing your chances of becoming a victim of fraud.

* Retruster.com