It is exceedingly difficult to make predictions, particularly about the future. –Niels Bohr (1885-1962), Danish physicist

Performance vs. Publicity: the Effects Pundits Have

As we approach the end of 2012 and contemplate the future direction of stock and bond markets as well as the value of many commodities it reminds us that it is sometimes difficult to separate the comments from the talking heads that dominate the network and financial news shows and the predictions of economic and political pundits from the deeper currents that shape the eventual long run outcomes. It is tempting and usually engaging to listen to these experts as they prognosticate with such confidence that it begins to wear down the barriers of cynicism.

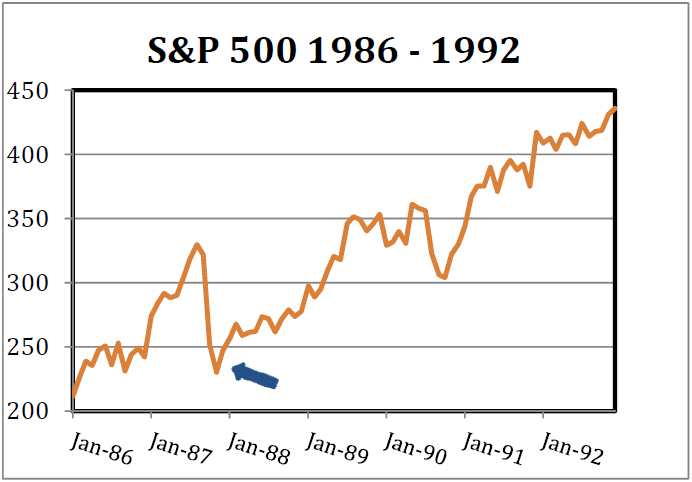

Twenty-five years ago this month one such expert almost became a household name by correctly predicting the 1987 crash. Elaine Garzarelli was a quantitative based analyst and money manager working for Shearson Lehman when she appeared on CNN on October 12, 1987 and predicted an imminent collapse. In a small article printed seven years later, an October 27, 1994 edition of The New York Times stated, “That [prediction] came not long after she had begun a mutual fund, and money soon poured into it. But its performance never matched the publicity, and the fund was quietly merged with another earlier this year.” Further, Ms. Garzarelli was “ousted” shortly thereafter. Importantly, as illustrated in the chart to the right, although the collapse erased a couple years of appreciation, the market was hitting new highs within two years subsequent to the collapse. While it was a major event, patient investors were rewarded by not reacting to the media frenzy that ensued. In the end, even a broken clock is right twice a day.

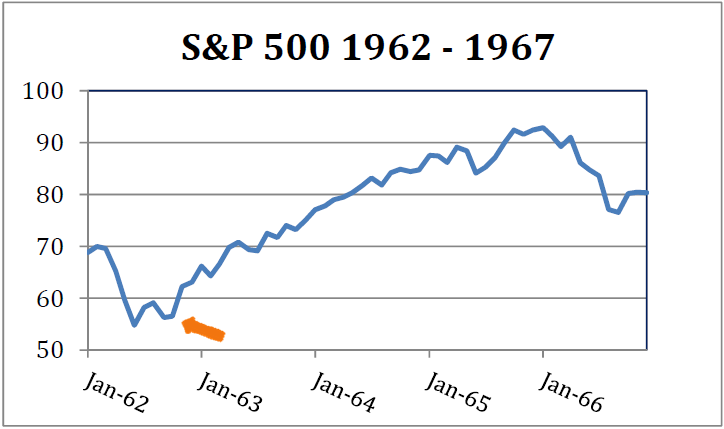

Reaching further back, 50 years ago this month, the United States was in the midst of the Cuban Missile Crisis. It is probably difficult for younger people to fully appreciate the Cold War and the effects it had on people’s outlook for the future.

At the height of the crisis on October 23rd, combined with other events in 1962, the S&P500 was down 25% for the year as indicated at left. Again, the crisis passed and the market appreciated nicely rewarding persistent investors for more than three years before the next bear market in 1966.

Those who have knowledge, don’t predict. Those who predict, don’t have knowledge. –Lao Tzu, 6th Century BC Chinese Poet

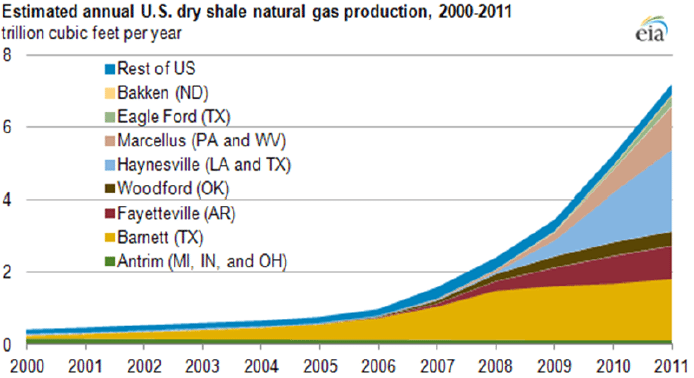

Interestingly, outside of dire forecasts concerning Europe and China, the financial news has had a focus on domestic natural gas and oil production. Less than a decade ago, experts were forecasting that the United States was rapidly running out of natural gas reserves and we needed to focus on alternative forms of energy. With the help of new technologies like horizontal drilling and hydraulic fracturing, we are now experiencing a boom in production that defies previous predictions. Below is a chart of the production of natural gas from shale formations using these technologies.

As we stressed in our previous missive, the long run drivers of stock market returns have been and will continue to be earnings and dividends. To recap, stock investing can provide reasonable long term returns commensurate with the growth in these metrics. In the end, it pays to be cautious about how much weight one places on predictions and forecasts of experts.

A governor (unknown) once told his department heads, “Never put a number and a date in the same sentence.” With that in mind, we will forsake our own predictions and simply thank you very much for the trust that you have placed in our firm. Please do not hesitate to contact us with any questions or concerns.